Welcome to the fifth and final instalment of our ELIS Discussion Series, where we delve into the latest insights from the 2024 ELIS Report. In this article, we explore how pricing models and expectations within the language services industry have evolved.

Anu Carnegie-Brown, Stephane Hue, and Ursula Steigerwald offer their expert perspectives on the shifting landscape of pricing, the impact of technology and productivity on pricing strategies, and how these changes affect both language service providers and clients. Join us as we dissect the complexities of pricing in a rapidly changing industry and uncover what really drives value today.

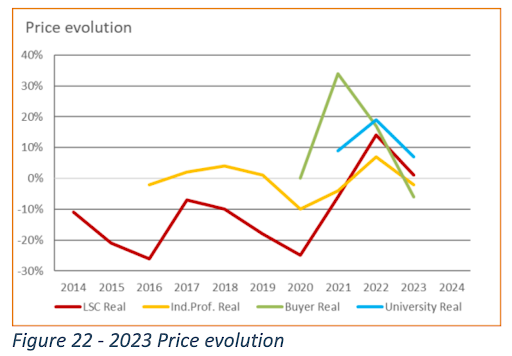

According to the report, “based on the price evolution in 2022, many language companies and independent professionals expected that the price increase would continue in 2023, while only a small majority of language departments agreed. The language departments had it right. 2023 price evolution was sobering, with a small (2%) but symbolically important majority of language professionals reporting a price drop instead of an increase, and language companies stating a status quo. Language departments agreed, with net 6% noting a price decrease.”

Is per-word pricing still relevant in today’s market? How is technology affecting pricing and productivity?

ACB: LSPs have a wide range of services that makes talk about one price or one way of pricing meaningless, except perhaps if you expressed the price in terms of an hourly rate. For enterprises with large-scale localisation programmes, the solution they pay for needs to cover management of source content, management of language assets (TMs, terminology, MT and LLM technology), quality control, vendor management, project management, and possibly the management of the content distribution channels.

Different language service providers, depending on their business model and place in the service supply chain, sell a different selection of these services. Some literally only sell words in another language. Others sell workflow solutions built on technology. Some focus on project management. Many become expert vendor pool managers for their clients and sell the service of finding and training local linguists for a certain target language.

US: We have been seeing an ever increasing complexity for linguistic projects that require enlarging service portfolios overall, offering tech savviness, defining new profiles for contributors to the industry and delivering a high number of services “around” the actual translation, or rather linguistic work. A per-word rate does not necessarily reflect this anymore and indeed an hourly equivalent might be more appropriate. However, this would require a complete revamp of the pricing structures applied currently in order to consider all the service elements required.

SH: If we look at the variations of the price per word, it would also be increasingly relevant to assess how much of the total turnover of LSPs is now charged on a per word basis. On top of this, a decline in price per word is supposed to be correlated to an increase in productivity provided mostly by technology and to a lesser extent by organisational efficiencies between supplier and client.

Of course, the challenge for LSPs is to invest correctly in technology solutions and gain enough productivity to relieve the pressure on price per word and maintain reasonable profitability levels.

Now, the perfect AI is not here (yet) and we all know it is difficult to have consistent productivity improvements all the time..

At the freelance translators level, the challenge is similar and relies on working faster (mostly post-editing) to maintain or increase their actual hourly rates.

Should the industry rethink its compensation models?

ACB: The payment models for text-based language services have become too analytical. We must remember that the price in the language services industry does not consist of the unit rate alone (e.g. a rate per word).

It also includes discounts given on that rate for translation memory matches and machine translation output. Some practices go further and compensate for editing effort only; a post-editing analysis is run on target segments and the compensation is based on how much editing the text required from the linguist.

US: There are indeed many many pricing models around. On the one hand, there are new models invented in order to reflect the application of tech solutions, but on the other hand, it is getting harder and harder to determine the actual effort behind the models. Cost savings are of course an important aspect behind these initiatives, but sometimes without a decent “reality check”.

In my opinion, the whole industry could benefit from a general discussion and agreement around compensation models for linguist tasks in the future.

SH: We have been experimenting with flat fees or subscriptions/monthly fees that are disconnected (to some extent) from the word counts. They are meeting the expectations of clients who want to control their budgets (not necessarily reduce their costs). This is in my opinion an interesting way forward.

On the linguists side, we should all focus on where they add the most value (QA, cultural adaptation, tuning translation engines, …) and make sure this is correctly compensated.

Are national statistics reflecting the true value of language services?

ACB: In the UK, and indeed in many other countries as well, the Office for National Statistics (ONS) has a variety of price tracking indices. They may contact an LSC at regular intervals to ask what rate the company charges for X (X being a word rate per one service per language pair). This kind of tracking is futile because it does not depict the full story of how compensation increases or decreases over the years. Very difficult to explain this to them, though.

US: In Germany, we see average rates and other statistics published by German industry associations (like BDÜ). These are still word based rates; most of the time new developments are not taken into consideration. Rates cited here do not reflect the reality that LSPs and linguists are facing. They would definitely need to be adapted.

SH: This is the same in France as well, with the National Institute for Statistics (INSEE) trying to compile a price index based on a few language pairs and only considering average price per word. They would also need to be adapted.

As the language services industry continues to evolve, so too must our approach to pricing. We invite you to join the conversation and share your thoughts on LinkedIn. How do you see pricing models changing in your company or across the industry?

Let’s shape the future of language services together. #ELIAdiscussion