Welcome to the first article in our ELIS 2025 Discussion Series, where we explore key findings from this year’s European Language Industry Survey. While there are many takeaways to reflect on, we’re starting with an important one: the noticeably lower response rate among Language Service Companies (LSCs).

This year’s report, released on 18 March 2025, gathers insights from 1322 participants across 50 countries—covering freelancers, LSCs, language departments, universities, and students. However, the number of LSCs responding dropped sharply, from 257 in 2024 to just 179 this year. What might this signal about the current state of the industry?

At ELIA, we’re committed to engaging with the ELIS report with an open and constructive mindset—especially in a time marked by uncertainty and growing concerns across the industry. The goal of our content committee is to identify the data points that matter, particularly for LSCs, and use them as a springboard for thoughtful, positive discussion that helps move the conversation—and the industry—forward.

As we examine the declining response rate, we’re joined once again by Anu Carnegie-Brown (ACB), Ursula Steigerwald (US), and Stéphane Hue (SH), who will be sharing their thoughts throughout the series.

Let’s dive into the discussion.

A shrinking sample, or a shrinking market?

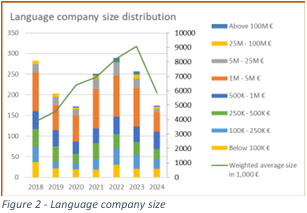

The number of language companies participating in ELIS 2025 has declined, especially among larger LSCs.

ACB: On the whole, 179 LSC respondents actually corresponds well with the number of European LSCs that actively engage in language industry matters, if we measure that engagement e.g. by how many LSCs are members of ELIA.

SH: Last year’s survey had more responses from LSCs with a turnover exceeding EUR 5M. Were these companies not interested in participating this year, or has their revenue declined so that they are no longer in the >EUR 5M category?

One possibility is that LSCs from this higher-revenue segment have either exited the market or dropped below the €5M line. According to this year’s survey, 88% of language company respondents had revenue below €5M, and 85% were family-owned. Only one respondent was a publicly listed company, and just 7% reported venture capital backing.

ACB: The report states that 88% of the language companies surveyed have revenues under EUR 5M. These companies, particularly those selling traditional translation services, are the ones that have faced significant challenges in the evolving language services market in the past year. It is thus reasonable to assume that the LSCs that have ceased operations in the past year belong to this size category and are no longer here to partake in the survey.

Reluctance to share during uncertain times?

The question arises: are companies still active, but simply choosing not to respond?

ACB: It’s understandable if LSCs with diminishing revenues are not keen to share their status reports, especially when these surveys indicate that there still seem to be plenty of other LSCs that are doing well and growing.

That discomfort is likely amplified by competitive pressures and the desire to project stability, even in a volatile market.

US: I am not sure, if it is safe to say, that the results of this survey seem to reflect more the academic/freelance/small LSC world? We can only draw this conclusion from the absence of larger companies responding—but this might not be enough?

SH: I would think also that larger LSCs are evolving faster to a different scope of services and may not consider themselves as belonging anymore to this survey focused on traditional language services.

Still, the data does suggest a strong skew toward smaller players: while LSCs in the €1–5M revenue range remain the dominant group, their share has dropped from 36% in 2024 to 26% in 2025, mirroring the broader shift in respondent profile.

Awareness and engagement

Another possibility is that the survey simply didn’t reach as many LSCs this year.

ACB: Seven language industry associations actively promoted the survey, implying that companies involved with any of these associations should have been aware of it. However, many companies providing language services may not identify as LSCs or belong to any associations. Determining the market share of these other providers would be interesting and valuable.

SH: An increasing number of companies are competing in the language services arena, but would not consider themselves to be LSCs because language or translation services are just a part of their services.

That’s an open challenge for us all—how do we ensure that the survey reaches all parts of the industry, including those who may not be closely tied to formal networks?

Looking ahead

Despite the lower response rate, the ELIS 2025 report remains a valuable temperature check for our industry. As stated in the introduction of the report presentation: “With excellent quality, outstanding service, and tech savviness, the language industry will have a future—despite all the negativity we are seeing currently.”

We couldn’t agree more. And that’s why this year, we’ll be using this series to dig deeper, question assumptions, and explore how the data can inspire resilience and adaptation.

Discussion topic:

Have you noticed fewer industry players in your region or niche this year? Are companies reluctant to share their performance, or are we seeing a real shift in who’s left in the market?

Let us know in the comments on LinkedIn—or tell us what questions you’d like us to explore in the next article in this series. #ELIAdiscussion